Are you a budding entrepreneur ready to take your business to the next level? Well, hold on tight because we’ve got the ultimate guide for you! You may have heard whispers about the importance of a business bank account UK, but when is the right time to make this crucial move? Fear not, as today we’re diving deep into the world of business finances in the UK. Whether you’re starting small or already flourishing, join us as we unveil everything you need to know about opening that oh-so-vital bank account. Get ready to unleash your entrepreneurial spirit and conquer new financial horizons!

Introduction: Understanding the Importance of a Business Bank Account

As a business owner, you may have many different financial decisions to make. One important decision that often gets overlooked is opening a business bank account. While it may seem like an unnecessary hassle, having a separate bank account for your business can offer numerous benefits and protections.

First and foremost, having a business bank account allows you to keep your personal and business finances separate. Mixing personal and business expenses can not only create confusion but also cause problems with taxes and accounting. With a dedicated business bank account, you can easily track your income and expenses, making it easier to file accurate tax returns and manage your cash flow.

In addition to proper bookkeeping, having a separate business bank account also provides legal protection for small businesses. By establishing clear separation between personal and business assets, you protect yourself from potential legal issues or liability claims against your company. In case of any legal disputes or audits, having organised financial records from a dedicated business bank account will help support the legitimacy of your operations.

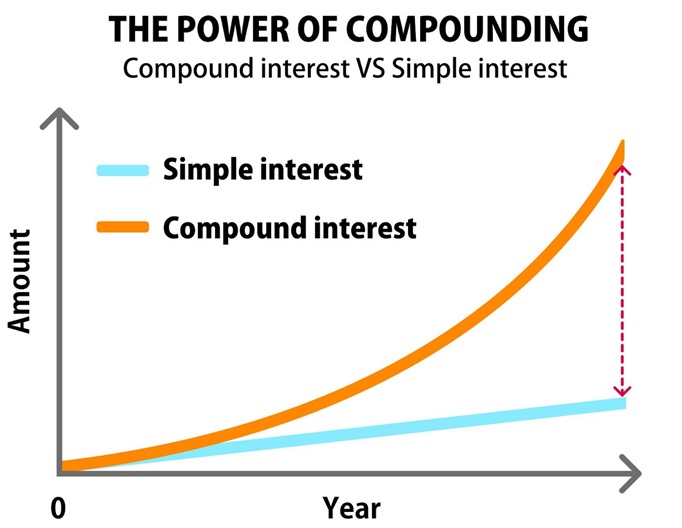

Furthermore, most banks offer additional features tailored specifically for businesses when opening a specific type of account. These features may include perks such as credit cards with higher limits, loans or lines of credit at better interest rates than those offered for personal accounts. These benefits are designed to help small businesses grow and succeed by providing them with access to necessary financing options.

Opening a dedicated business bank account also adds credibility to your company in the eyes of clients, suppliers, and lenders. Having checks written out under your company’s name rather than personal name lends legitimacy to your brand and shows professionalism in managing finances.

Moreover, keeping track of cash flow through a dedicated business bank account makes it easier for you to monitor expenses and ensure timely payments are made towards bills or employees’ salaries without dipping into personal funds. This level of organisation will contribute greatly towards maintaining healthy finances for long-term success.

While some small business owners may be tempted to use their personal bank accounts for business purposes, the benefits of having a dedicated business bank account outweigh any initial inconvenience or cost. From proper bookkeeping and legal protection to access to tailored financial services and increased credibility, a separate business bank account is an essential tool for businesses looking to thrive in the long run.

Benefits of Having a Business Bank Account in the UK

Opening a business bank account in the UK offers numerous benefits that can help your company thrive and grow. Whether you are just starting your business or have been operating for some time, having a dedicated business bank account can provide many advantages.

1. Professionalism and Credibility

Having a separate business bank account showcases professionalism and credibility to your clients, suppliers, and potential investors. It shows that you are serious about your business and have taken the necessary steps to establish it as a legitimate entity. This can also help build trust with your stakeholders, which is crucial for long-term success.

2. Separation of Personal and Business Finances

One of the most significant benefits of having a business bank account is the separation of personal and business finances. Mixing personal expenses with business transactions can create confusion and make it challenging to track profits and losses accurately. With a dedicated business account, you can easily keep track of all income and expenses related to your company.

3. Simplified Bookkeeping

Separating personal and business finances also simplifies bookkeeping for tax purposes. Having all your business transactions in one place makes it easier to calculate taxes owed, claim deductions, and provide evidence in case of an audit by HM Revenue & Customs (HMRC). Additionally, some banks offer accounting software integration with their accounts, making it even more streamlined to manage your financial records.

4. Improved Cash Flow Management

A designated business bank account allows for better cash flow management by providing access to various tools such as online banking, electronic payments (BACS), direct debits, standing orders, etc., making it easier to manage incoming revenue and outgoing expenses efficiently.

5. Access to Financing Options

Having a solid relationship with a bank through your business account can open up financing options when needed in the future. Lenders may be more willing to provide loans or credit facilities if they see that you have maintained good financial standing with your bank.

6. Increased Security

Business bank accounts offer increased security compared to personal accounts. Banks have robust systems in place to protect their business customers’ funds, reducing the risk of fraud and cybercrime.

Having a dedicated business bank account in the UK offers a wide range of benefits that can help your company succeed and thrive. It not only provides a professional image but also simplifies financial management, improves cash flow, and opens up potential financing options. Therefore, it is crucial to open a business bank account at the right time for your business’s long-term success.

Factors to Consider Before Opening a Business Bank Account

Opening a business bank account is an important step for any entrepreneur or small business owner. It not only helps to keep personal and business finances separate, but also provides access to essential financial tools and services that can help the business grow. However, before rushing to open a business bank account, there are several factors that need to be considered.

1. Type of Business Structure:

The first factor to consider before opening a business bank account is the legal structure of your business. The type of entity you have registered as (sole proprietorship, partnership, limited liability company etc.) will determine the type of account you can open and the documents required.

2. Banking Needs:

Before choosing a bank for your business, it is important to assess your banking needs. What services do you need? Will you require loans or credit facilities in the future? Do you need multiple accounts for different purposes? These questions will help you choose a bank that can cater to your specific needs.

3. Fees and Charges:

Another crucial consideration is the fees and charges associated with maintaining a business bank account. Different banks have different fee structures and it is important to compare them before making a decision. Look out for hidden charges such as monthly maintenance fees, transaction fees, ATM fees etc.

4. Minimum Balance Requirement:

Most banks have minimum balance requirements for their business accounts which may vary depending on the type of account and the bank itself. Make sure you understand these requirements before opening an account as falling below the minimum balance could result in additional charges or even closure of your account.

5.Payments Processing Time:

For businesses that deal with large volumes of payments, it is important to consider how long it takes for payments made into your account to clear. This can affect cash flow management and impact operations if not taken into consideration.

6.Online Banking Services:

In today’s digital age, having online banking services is crucial for efficient financial management. Before opening an account, make sure the bank offers online banking facilities such as fund transfers, bill payments, and access to statements.

7. Customer Service and Support:

It is important to choose a bank that provides good customer service and support. As a business owner, you may need assistance with various banking processes or have queries related to your account. A reliable and responsive customer service can save you from unnecessary stress and delays.

Opening a business bank account is not a decision that should be taken lightly. It requires careful consideration of several factors in order to find the best fit for your business needs. By taking these factors into account, you can ensure that your business’s financial management runs smoothly and efficiently.

When is the Right Time to Open a Business Bank Account?

When it comes to starting a business, one of the most important decisions you’ll need to make is when to open a business bank account. This can be a daunting task for many entrepreneurs, as there are several factors that need to be taken into consideration.

The right time to open a business bank account varies depending on the type of business you have and your individual circumstances. However, there are some general guidelines that can help you determine when it’s the best time for you to open one.

Firstly, it’s important to understand why having a separate bank account for your business is crucial. One of the main reasons is that it helps keep your personal and business finances separate. This not only makes accounting and tax filing easier but also provides liability protection in case of any legal issues. In addition, having a dedicated business bank account builds credibility with customers and suppliers, as they can see that you are running a legitimate operation.

For sole traders or partnerships, opening a business bank account may not be necessary if the transactions are minimal and easily distinguishable from personal expenses. However, once the volume of transactions increases or if there are multiple partners involved, it’s recommended to open a dedicated account.

For limited companies or LLPs (limited liability partnerships), opening a separate business bank account is essential from day one. As these types of businesses have their own legal entity status, all financial dealings should be conducted through their respective accounts.

Another factor to consider is whether your business has started generating income yet. If you’re still in the planning stages or just starting out with no significant revenue coming in, postponing opening a business bank account may be wise until your cash flow improves. This will save you from paying unnecessary fees associated with maintaining an active account.

On the other hand, if your company has already begun trading and generating income, then it’s definitely time to look into opening a dedicated business bank account. Not only will this make managing finances easier, but it will also help you keep track of your business’s growth and success.

The right time to open a business bank account in the UK varies depending on individual circumstances. However, as a general rule of thumb, it’s best to open one as soon as your business has started generating income or when transactions become more frequent. Remember, having a separate business bank account not only helps with financial management but also provides protection and credibility for your business. So don’t delay any further and start looking into opening a dedicated account today.

Conclusion

In conclusion, opening a business bank account in the UK is an important step for any entrepreneur. It not only helps with managing finances and staying organized but also adds credibility to your business. By following our guide and considering factors such as legal structure, banking fees, and additional services offered, you can make the right decision on when to open a business bank account that best suits your needs. Remember, it’s never too early to start building a strong financial foundation for your business’ success.